Last Thursday, Sean Brodrick, contributing author of Uncommon Wisdom which is published by Weiss Research, Inc., had the opportunity to get together with Bob Archer, President and CEO of Great Panther Resources. Sean knows Bob and several years back had the opportunity to tour the Company’s Guanajuato and Topia mines. With everything that Great Panther has going on right now, it only made sense for Bob and Sean to reunite and for Bob to bring Sean up to speed on the Company and its opportunities. The following is an excerpt from Sean’s report based on his meeting with Bob, a complete copy of which can be found here.

“When gold and silver prices pull back, I like to buy precious metals and the companies that mine them — and you probably do, too. But when you get that pullback, what do you buy?

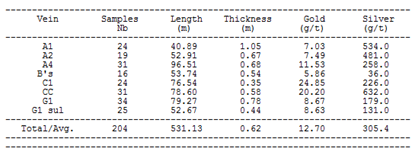

One that I like is Great Panther Resources (GPR on the TSX, GPRLF on the pink sheets in the U.S.). Great Panther is a Canadian miner operating primary silver mines in Mexico, with some gold and base metals also in the mix. I’ve visited their projects at Guanajuato and Topia in the past, and I was very impressed by what I saw. And last week I had lunch with Bob Archer, Great Panther’s CEO.

Recently, Great Panther has announced a parade of good news. Production is booming, mining costs are dropping, and the company has “blue-sky” potential in new zones it is exploring.”

Posted by babybulltwits

Posted by babybulltwits

Saudis Drop WTI Oil Contract

October 29, 2009By Javier Blas in London

Published: October 28 2009 20:27 | Last updated: October 28 2009 20:27

Saudi Arabia on Wednesday decided to drop the widely used West Texas Intermediate oil contract as the benchmark for pricing its oil, dealing a serious blow to the New York Mercantile Exchange.

The decision by the world’s biggest oil exporter could encourage other producers to abandon the benchmark and threatens the dominance of the world’s most heavily traded oil futures contract. It is the main contract traded on Nymex.

The move reveals the growing discontent of Riyadh and its US refinery customers with WTI after the price of the price of the benchmark became separated from the global oil market this year.

The surge in oil inventories in Cushing, Oklahoma, where WTI is delivered into America’s pipeline system, depressed the value of the WTI against other global benchmarks, throwing the global oil market into disarray.

Read More